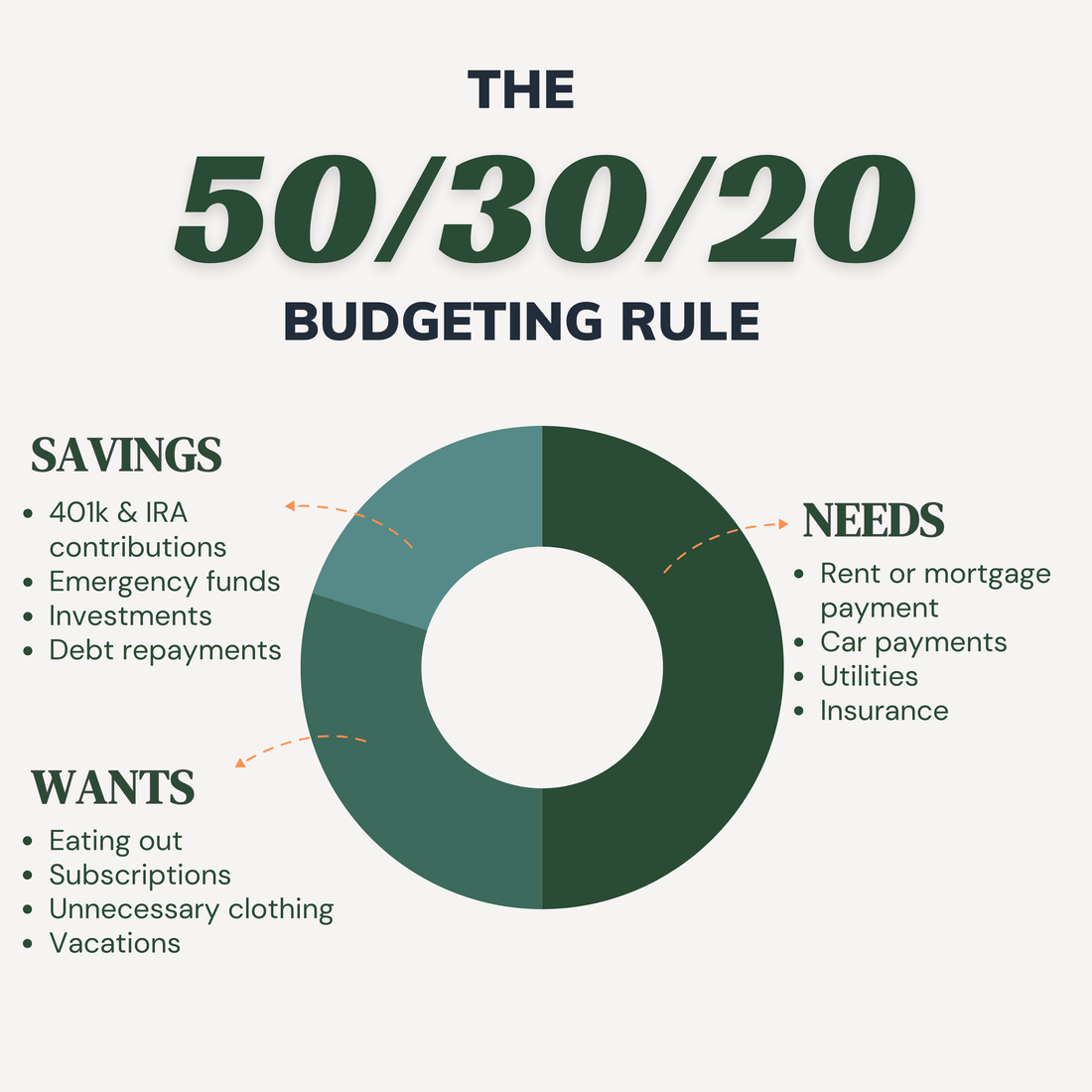

If you've done some research on budgeting or saving, you may have heard of the 50-30-20 rule. We're going to discuss what this rule is and how it can help you keep your budget organized so you can save more and limit unnecessary spending.

The overall concept of the 50-30-20 rule is to allocate 50% of your income (after taxes and before 401k withdrawals) to needs, 30% to wants, and 20% to savings and debt repayment. The purpose of this rule is to balance paying for necessities while being mindful of longer-term savings and retirement.

Now lets break down what each category includes:

Needs (50%):

A need is anything that is essential for survival. This includes things such as

- Rent or mortgage payment

- Car payments

- Utilities

- Insurance and healthcare

- Minimum debt payments

- and anything else that is mandatory for working or survival

Wants (30%):

A want is exactly what it sounds like, anything that you want but isn't absolutely essential. Wants include things such as

- Eating out

- Subscriptions

- Unnecessary clothing

- Vacations

- etc.

By setting aside money for wants, you're able to have a more realistic approach to your budget and finances. It's inevitable that you're going to spend money on extras, so by planning for it you are able to work those expenses into your budget.

Savings (20%):

Savings and debt repayment are the last category in the 50-30-20 rule. Things such as the following fall under this category.

- 401k & IRA contributions

- Emergency funds

- Investments

- Debt repayments (anything extra after minimums)

The 50-30-20 budgeting method is a great way to ensure you're not overspending on wants and allocating enough money to your savings and needs. It's also a great way to avoid lifestyle creep since it is percentage-based and not a fixed dollar amount. It's important to note that the percentages can be adjusted. If you don't need 50% of your income for needs or 30% for wants, it's always best to increase that savings percentage as much as possible.

The only aspect that I don't love is this rule considers your net income before 401k contributions. If your income allows for it, I always think its best to go off your net income after your 401k contributions. This allows you to save more for any large purchases, sinking funds, life expenses, etc. in addition to your retirement. I would suggest trying this method first and adding your 401k in if you find your budget is too constrained.

Overall, I think this is a great method for anyone looking for more structure in their monthly budgeting routine. Let us know if you have tried the 50-30-20 rule and what your thoughts are!